Our Commitment to Fiduciary Duty

Who can you trust to give you reliable investment advice? If you are like most people, you assume that the people who provide investment advice are required to act in your best interest. Unfortunately, that’s only true for some advisors – those who are fiduciaries.

Under financial laws and regulations, there are two sets of rules. One set is for people who sell financial products, generally brokers and insurance company representatives. These salespeople are contractually obligated to place the interests of their employer ahead of the interests of their clients.

The other set of rules is for those who are registered as investment advisers with the federal Securities and Exchange Commission (SEC) or comparable state regulators. Registered investment advisers are legally obligated to place your interests first. They are fiduciaries. That means they must not only be loyal to serving your exclusive best interests, they must also adhere to a high standard of professional competence.

Unlike other classic professions, such as law and medicine, anyone can call himself an investment or financial advisor even if they are really a salesperson. Recent financial reform legislation is attempting to change this situation but there are powerful and extraordinarily well-funded financial service company lobbying organizations working overtime to protect the status quo.

We are part of a grassroots organization of financial service professionals known as the Committee for the Fiduciary Standard. The Committee’s goal is to educate legislators, regulators and the investing public about the importance of protecting investors by extending the fiduciary standard to cover everyone who provides personalized investment advice.

Interestingly, the Committee includes a number of brokers and insurance representatives, in addition to registered investment advisers, who recognize how important it is to investors and society at large for advice to be truly trustworthy based upon a uniform standard that requires advisors to be objective and competent.

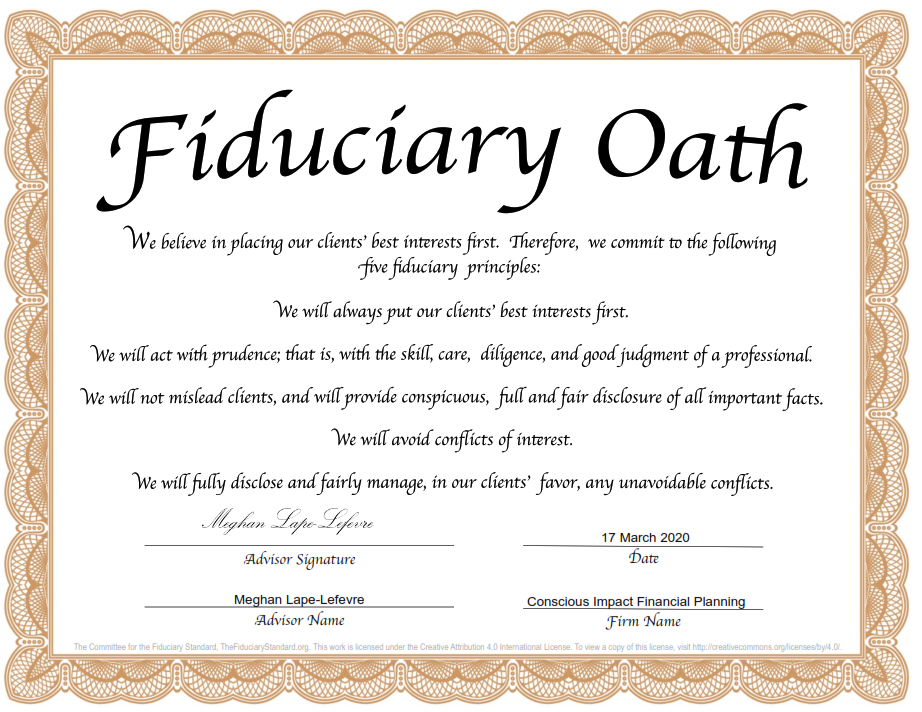

We are not willing to wait for legislators and regulators to do the right thing and you shouldn’t be willing to wait either. The Committee has drafted the very straight-forward oath you will find below that commits an advisor to adhere to a fiduciary ethic and, in so doing, to be accountable for the advice the advisor renders to you, the client.

We strongly recommend that you insist that any advisor you hire is willing to sign this oath. The commitment is as simple as “mom and pop and apple pie.” If they won’t sign the oath, you owe it to yourself to ask why you would trust your financial future to their care. I encourage you to share this letter and the oath with your family and friends.