If you’ve been fighting debt, you’re not alone. As it stands, the average American has $15,950 in credit card debt, and 39% of Americans carry a balance from month to month.1 Those figures aren’t counting people with mortgages, student loans, car notes, personal loans and medical bills.

There are a number of underlying issues that contribute to this problem, which are both psychological and emotional. When debt becomes a burden, these effects can be devastating, affecting people in a variety of ways. Here are a few:

Anxiety and Depression

Studies have shown that individuals who struggle with debt are more likely to also suffer from depression and anxiety. This may cause headaches, or an inability to focus or function. There is also a high link between suicide and debt, and people who commit suicide are eight times more likely to be in debt.

Resentment

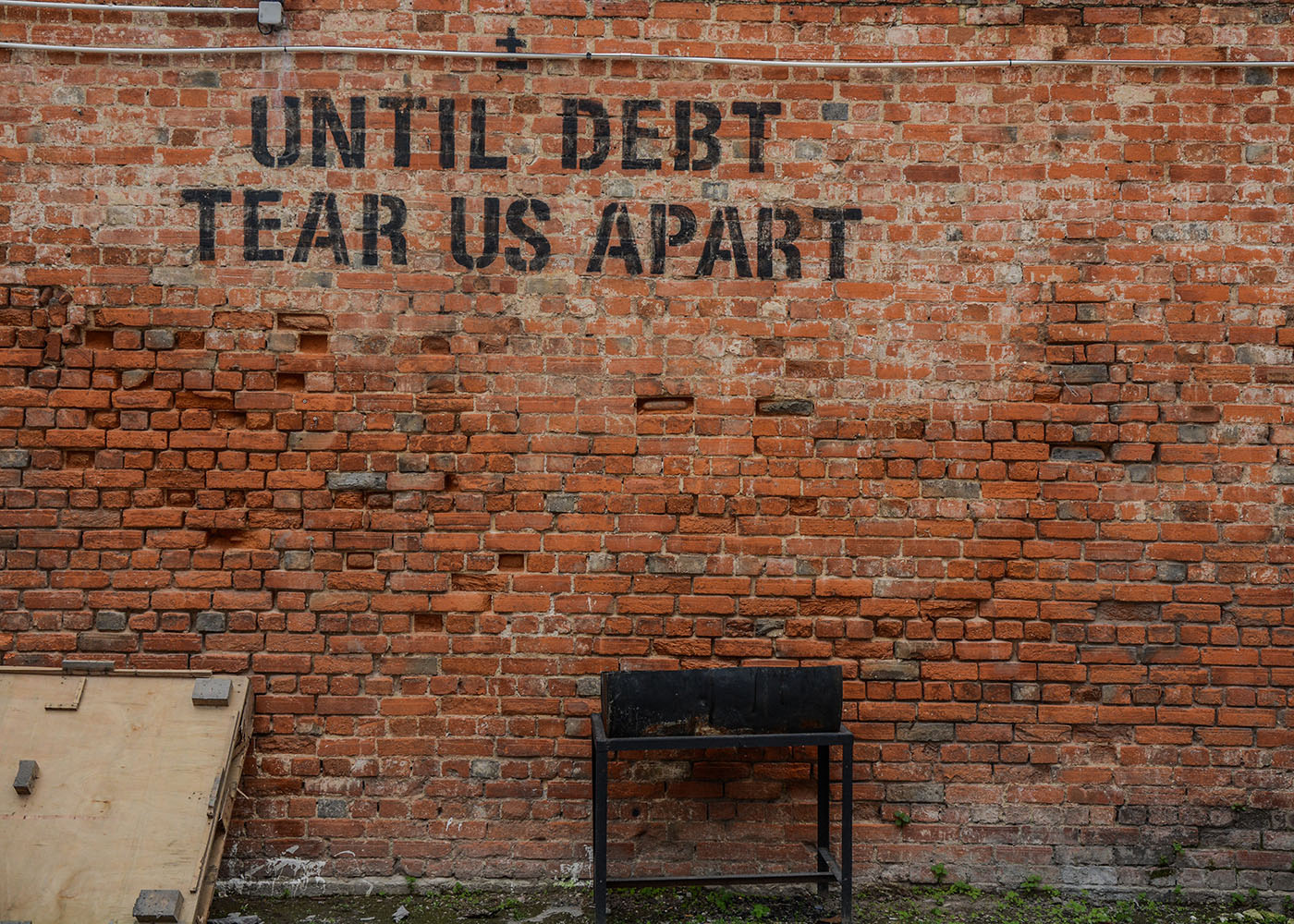

When debt becomes a problem, so can resentment, especially in relationships. According to family studies at Kansas State University, disagreements about money is a top predictor in divorce.2 When there are large amounts of debt within a household, it creates a dark cloud and resentment may start to set in.

Denial

One of the ways to deal with the emotional stress of debt is to not deal with it at all. When people feel overwhelmed, denial of the situation often seems easier than taking the first step toward fixing the problem. The constant reminders of those bills that need to be paid, calls from creditors, and consistent overdraft or over the limit charges can cause a toll. Many people feel that if they act as if the problem doesn’t exist, it will go away. Instead, this creates a reverse effect, as balances grow higher and the debt continues to grow.

Stress

When debts are looming and there is not enough money to pay, stress quickly becomes a factor. Debt can create stress that makes even the most positive of circumstances seem bleak. Just the thought of having a phone call from a creditor, or facing another bill that cannot be paid on time can cause health problems, anxiety and depression.

Frustration

Frustration often leads to anger. It can be frustrating knowing debt is a major problem and that you may or may not have had a direct impact on the situation. When you feel as if you’re up against a wall, frustration can make you do impulsive things. No one likes to deal with the effects of unwanted stress, especially in instance where you may have no control over the debt, such as medical emergencies or the loss of a job.

Regret

If you have put yourself in debt and are now fighting to keep your head above water, you could go through a period of regret. This is something a number of students who are strapped with student loans experience. They did not understand how quickly the grace period would come, or how quickly interest would accrue, and now facing a mountain of debt when first starting a career is challenging.

Embarrassment

Once the regretful period is over and reality starts to sink in, a period of embarrassment may take place. Who wants to tell people they can’t go out to dinner, or participate in other entertainment events because they are in a mountain of debt? The higher the debt, the more embarrassed someone may feel. Once you get into this stage, the fear of not being able to pay can take hold. The first thing to remember is you are not alone.

There are many people going through all these feelings as it relates to debt. Understanding the problem and implementing steps to overcome the problem is the only way these feelings of inadequacy will start to fade. Once you start making baby steps and see the debt vanishing, the sense of accomplishment is priceless. If you feel yourself having these symptoms, talking to a financial professional who specializes in debt reduction is a great first step in the right direction.

- http://onlinelibrary.wiley.com/doi/10.1111/j.1468-0297.2012.02519.x/abstract

- https://www.k-state.edu/media/newsreleases/jul13/predictingdivorce71113.html

This content is developed from sources believed to be providing accurate information, and provided by Twenty Over Ten. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.